Recent data about gender (in)balance in the digital world shows that women make up only 4% of the engineering sector and about 10% of the VC community, while just 1 tech company out of 10 has a woman among its founders. Matha Lane Fox's hope is that "The UK can become the country with the most gendered-balanced digital sector in the world."

Martha Lane Fox has been a pioneer of digital culture and technology in the UK. She is calling for the creation of a national institution to lead an ambitious change - to make Britain brilliant at the internet.

Delta2020 supports Martha Lane Fox's petition to create DOT EVERYONE a public institution for the digital age.

Here we share a recent article written by Andrew Griffin from Oakhall Advisors that provides a valuable insight for private companies on how to pitch to potential investors.

Pitch perfect

Most pitches by private companies to potential investors fail. Bad ideas are of course the main problem, but the way companies communicate is also a barrier. Putting your pitch together in a way that actually answers investors’ questions in a structured way will help you identify if you have thought your strategy through properly.

We have a digital revolution in the UK, but lack the data and sector classification to effectively measure and exploit it. Currently its contribution is hidden away in the wider services sector, which makes up almost 80% of the UK economy. We previously explored this subject in Is the UK Missing a Trick? It's Time to Recognise 'Digital Manufacturing'.

Recently this theme has re-emerged following Sir Charlie Bean, former deputy governor of the Bank of England, arguing that the internet revolution has rendered Britain’s official statistics out of date. We thought it worthy of revisiting the topic, this time with supporting data from the Boston Consulting Group (BCG).

The UK’s digital economy is an engine of growth

Dr Ian Jauncey is a Jersey based entrepreneur and investor. He was the lead in the world beating team that invented the first optical fibre amplifier, the key global communications technology that enabled the internet. He now runs Infinite Lightbulb, where he seeks out disruptive technology ideas, and looks to support them with investment and his experience in execution. Here we share Dr Jauncey's market commentary on the impact that the crowd mentality can have on company valuations and potential 'bubbles'.

When GoPro went public in June 2014, the indicative price was $21-$24 per share, valuing the company at $2.95 billion. On the first day of trading the shares moved up 30%. The next day it was 14%, the next 13%. Within a week it had doubled it's share price. By October, the price was $94. Forbes commented that GoPro was "unstoppable". Nick was worth near $3bn. He sold some shares and bought a Jetstream.

Then the unthinkable happened. The share price started to fall. By March this year, they had fallen back to less than $38. So what went wrong?

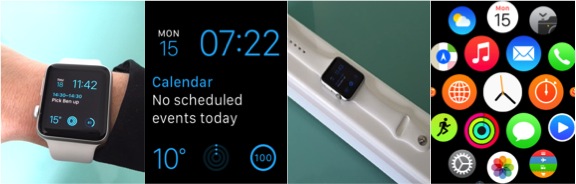

The Apple Watch was the first new product category Apple had launched in five years, setting the bar and raising smartwatch awareness.

Smartwatches may not appeal to everyone, however the industry has continued to grow at a phenomenal rate. We previously explored this in ‘Is now the time of the Smartwatch?’

Apple’s CEO Tim Cook stated that the Apple watch is “the most personal device Apple has ever created,” adding: “It is not a shrunken iPhone. It is a new, innovative way to communicate directly from your wrist.”

At the end of 2014, we looked towards the year ahead and the risks which could have an impact on UK economic growth. Now that we are over half way through 2015, we thought it was a good time to revisit and update our thoughts. UK political uncertainty has gone, however the other highlighted risks noted remain largely the same.

In 2014, the UK economy grew 3%. Forecasted growth rates for 2015 and 2016 have faced cuts following a slowdown at the start of the year. Official figures indicated the UK’s growth rate halved in the opening months of 2015. In July, The OBR revised its 2015 GDP forecast downwards to 2.4% from the previous forecast of 2.5%. Other forecasters have made similar cuts. This year’s rate of growth is likely to be lower than 2014 but still a respectable 2.3-2.5%.

Here we revisit some of the domestic and global risks which could have a knock on impact on the UK growth outlook for the remainder of 2015.

London is a hotbed of technology and digital innovation. While on work experience, young technopreneur, Asher Fischbaum, provided us with his take on the London start-up scene and how to go about launching a new venture in the capital.

![]()

Silicon Roundabout lies at the centre of London’s digital tech cluster

So you have a big idea? Your market research suggests you have a viable product or service? Welcome to London, one of the leading tech hubs in the world, with particular strengths in sectors such as fintech, software and web based services. It’s a place full of creatively minded and talented individuals, funding to follow the best ideas, supported by government initiatives, and seen as a desirable place to live. This collection of positive factors has allowed the London technology landscape to grow at a rapid pace and provides over 582,000 jobs per year.

The London tech start-up scene is bustling with new teams being formed every day, in the hope of creating the next big thing. So how do you get started?

Proxy servers – How may they serve you?

Servers are an integral part of the world’s digital ecosystem. They come in many different forms and ‘serve’ many different purposes. While on work experience, Charles Drew of Bishop's Stortford College, explored the role of proxy servers and how businesses are benefiting from their use.

Bitcoin: boom or bust?

The definitions of Bitcoin and Blockchain have been previously covered in ‘Confused by cryptocurrencies? Bemused by Bitcoin? Baffled by Blockchain?’ While on work experience, Alex Sokhanvari of Bishop’s Stortford College took a deeper look at whether the hype and attention surrounding Bitcoin is warranted and how its future may pan out.

Bitcoin’s volatility sees it feature in the media on a regular basis. Bitcoin by analogy, is like being able to send a gold coin via email. It is a peer-to-peer online payment system that introduces an entirely digital currency. Could Bitcoin revolutionise the way we make our payments? Or could it just be a passing fad that will fade and be forgotten?

Jon Reynolds, CEO of SwiftKey, has been awarded the number one spot in the FT Magazine’s list of Top 10 under 30 European tech entrepreneurs.

Jon co-founded SwiftKey in 2008, aged just 22. Prior to that, he worked as a civil servant in the British government, having graduated with MA in Natural Sciences from the University of Cambridge. It was at Cambridge where he met co-founder and CTO, Dr. Ben Medlock who completed a PhD in artificial intelligence (AI) at Cambridge.

Jon had noticed the trend of mobiles gradually replacing PCs and that the shrunken touchscreen keyboards weren’t fit for purpose. He and Medlock started talking about using AI to tackle the problem and came up with the idea behind SwiftKey.

While on work experience, Jack Bassett from John Hampden Grammar School explored a hot topic of public debate – encryption.

Data security, more specifically encryption, is as old as the art of communication itself. The word encryption derives from the Greek word kryptos, meaning hidden or secret and has been used throughout history, with applications from the Egyptians through to the Second World War, and is becoming an ever more pervasive theme in modern day society.

While on work experience, Henry Walton of Hockerill Anglo-European College looked into the growing Smartwatch phenomenon.

Is now the time of the Smartwatch?

Growth of the Industry

2012 saw the rise of a new industry following the success of the newly founded smartwatch company Pebble. The company pitched their e-ink display smartwatch to crowdfunding platform Kickstarter in April that year and received $100,000 in the first 2 hours after the project went live. The project went on to raise over $10,000,000 from 70,000 backers, demonstrating the substantial demand for intelligent wearable technology.

The Pebble Watch

Although fitness bands and simplistic smartwatches have been in existence for almost 10 years, it was Pebble’s success that acted as the catalyst for the smartwatch industry’s growth. Other major brands such as Samsung, LG and Motorola quickly followed suit and released their own products across 2013/14.