We have a digital revolution in the UK, but lack the data and sector classification to effectively measure and exploit it. Currently its contribution is hidden away in the wider services sector, which makes up almost 80% of the UK economy. We previously explored this subject in Is the UK Missing a Trick? It's Time to Recognise 'Digital Manufacturing'.

Recently this theme has re-emerged following Sir Charlie Bean, former deputy governor of the Bank of England, arguing that the internet revolution has rendered Britain’s official statistics out of date. We thought it worthy of revisiting the topic, this time with supporting data from the Boston Consulting Group (BCG).

The UK’s digital economy is an engine of growth

The transition from analogue to digital

Long gone are the days when the UK was an industrial superpower exporting ‘analogue manufacturing’ output around the world. But there is a different revolution going on today, and the UK is at the forefront of it. The digital revolution offers a real opportunity for the rebalancing the UK economy, enabling it to once again earn significant income from products and services sold internationally.

New economies, old measures

The definition of the digital economy, sometimes referred to as the internet economy, isn’t universally agreed on. When discussing digital manufacturing, we focused on the output of digital goods and services. What is more clearly agreed on, is that it moves at a rapid pace. The same however can’t always be said for the national statistics that measure it. Sir Charlie Bean was recently appointed by the UK government to lead a root-and-branch review of the UK’s economic statistics. In an article in the Financial Times he argued that the traditional divisions of industrial sectors were increasingly out of date, commenting “As an economy develops, the traditional ways of thinking about it cease to be so relevant”.

Research conducted this year by BCG into the role of the internet* economy, which is not split out in official statistical measures, has gone some way to highlighting this. Here are their key findings findings:

- In 2015, the internet contributed an estimated £180bn to the UK economy, equivalent to around 10% of GDP.

- If it were a sector, the Internet would be the UK’s second-biggest economic contributor behind the property sector, having overtaken retail, manufacturing and financial services.

- The internet economy has been steadily growing as a % of real UK GDP, from 8.2% in 2010 to a forecast 11.4% in 2018.

- It is anticipated that the value of the internet economy will double in size between 2010 and 2020.

- The UK internet economy is projected to grow 6% per annum between 2016 - 2018.

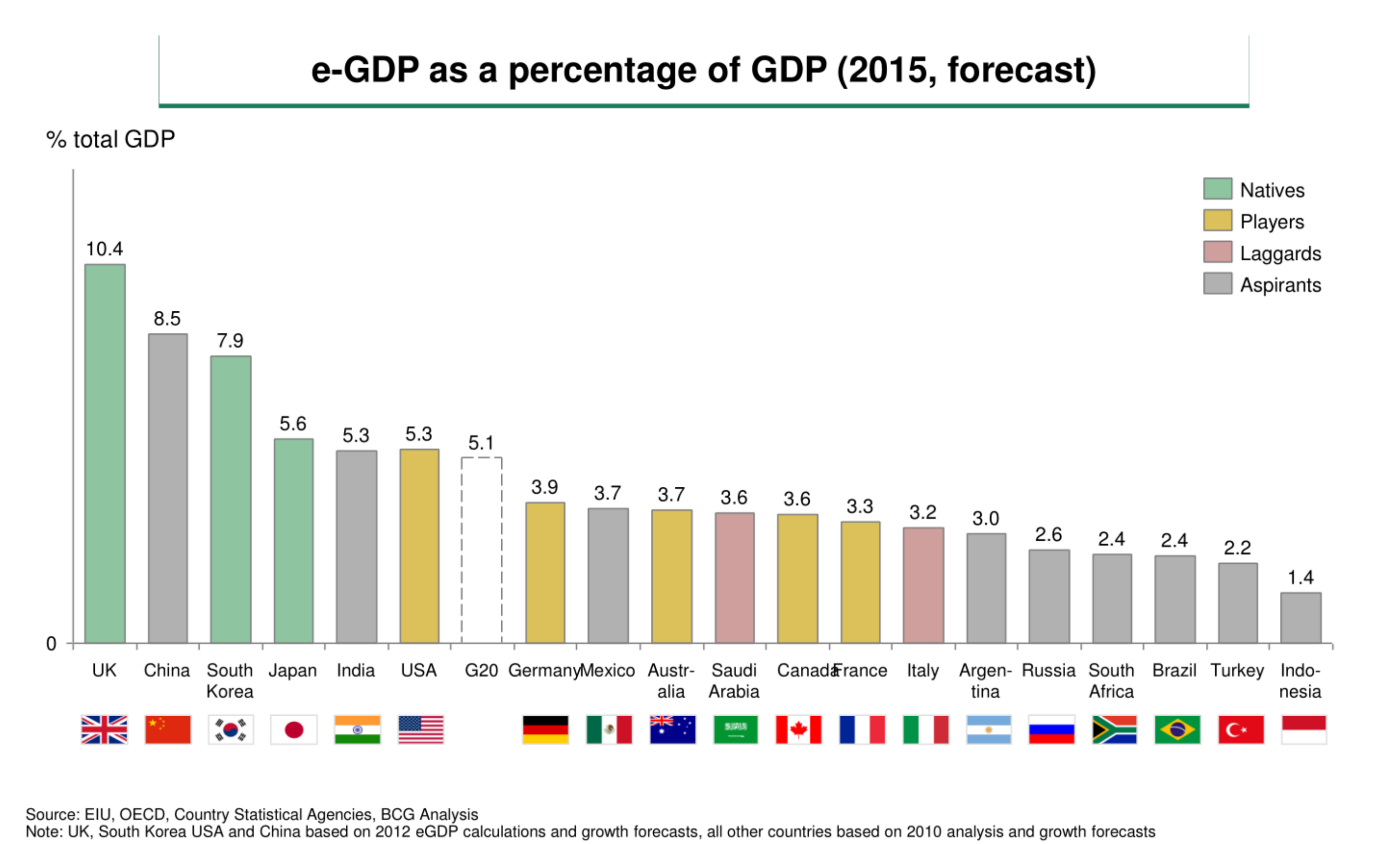

- Among G-20** countries, the UK’s digital economy is the largest as a proportion of GDP.

- By 2016, the Internet economy will be contributing 12.4% of GDP in the UK, compared with a G-20 average of 5.3%.

- The Internet is the fastest-growing component of the economy in the developed and developing markets of the G-20.

Source: Boston Consulting Group - UK eGDP 2010-2018 Summary of forecasts (April 2015)

As the data from BCG supports, the digital economy offers a significant growth opportunity vs the rest of the economy as a whole, and the UK has a major global role to play. As well as growth potential and job creation, the digital economy can also serve as a solution to the UK’s productivity puzzle. But to effectively do so, it is necessary to measure performance in order to manage improvement.

Time for recognition

The digital revolution is far reaching and its impact will be felt across all sectors. But by capturing data on its impact as a standalone sector, it allows for strategies to be developed to fully it exploit it. This is why it’s time for better sector recognition and measurement of the digital revolution and by doing so, we can enhance the UK’s leading international position, and future growth.

*The breakdown of the Internet economy in the UK includes online retailing, sales of Internet-related devices, IT and telecommunications investments, and Internet-related government spending.

** G-20 countries are Argentina, Australia, Brazil, Canada, China, EU, France, Germany, Italy, India, Indonesia, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, UK and US.

Sources

www.ft.com/cms/s/0/69b31022-3ac1-11e5-bbd1-b37bc06f590c.html

http://www.bcg.com/news/press/1may2015-internet-contributes-10-percent-gdp-uk-economy.aspx

https://www.swipe.to/6558dm - Boston Consulting Group - UK eGDP 2010-2018 Summary of forecasts (April 2015)

www.digitalcatapultcentre.org.uk%2Ftech-nation-powering-the-digital-economy [image credit]