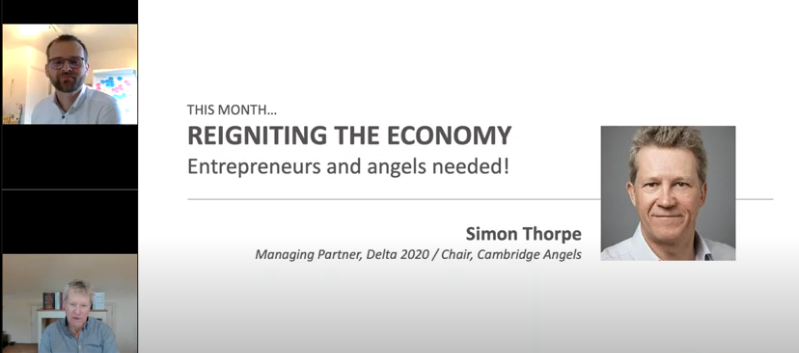

On Alembic Strategy Café’s livecast - Reigniting the Economy I spoke about supporting entrepreneurs leading the digital revolution.

• The pandemic has accelerated e-commerce and the digitisation of many sectors of the economy led by Healthcare and Education.

• Angel investors understand that building businesses of scale take at least 7-10 years, which is why it is called ‘patient capital’. So ‘don’t sell too early’.

• The UK is well positioned as a global AI leader having invested as much in AI R&D as the rest of Europe. It’s 3rd behind the US and China.

• The workforce of the future will need digital skills. Therefore we need to start with Schools teaching technology and financial literacy.

• The pandemic has mimicked ‘war-time’ urgency forcing companies to refocus on their business models (pivot if necessary) and show leadership qualities. Successful CEO’s have understood the importance of resilience, being a good role model, showing transparency along with exemplary communication skills to ensure the wellbeing of their teams.

Click here to listen.