Abundance Generation won a ‘Gold’ Ashden Award, the UK’s most prestigious green award. As part of the coverage of award winners, Ashden has produced a short video featuring Abundance’s Managing Director, Louise Wilson, explaining Abundance’s renewable energy crowdfunding platform. Louise also participated in an interview with Ashden as part of their Women in Power series.

Transferring money by mobile phone is set to get easier with the launch of a new mobile payments system called Paym (pronounced “Pay Em”). It allows people to pay using just their phone number, taking the hassle out of having to provide sort codes and account numbers. The service will launch on the 29th April 2014 (1).

UK IOUs and informal loans are worth £12.6bn a year according to research by IOU UK (2). The new service is aimed at making it easier for friends and family to pay each other, for such occurrences as a split restaurant bill or the purchase of event tickets, or could even be used to pay the plumber for fixing the boiler. At the moment Paym can only be used for payments between individuals, and not retailers. Users will be able to send up to £250 a day and transfers will be completed almost immediately.

How does it work?

Google’s acquisition of DeepMind Technologies generated much interest in the field of artificial intelligence (AI). When Google makes its largest ever EU acquisition at a rumoured £400m, people take notice. When the acquired company doesn’t have a single commercially available product and is virtually unheard of, intrigue is heightened.

DeepMind is a London-based artificial intelligence firm which specialises in machine learning, advanced algorithms and systems neuroscience. So far, its technology has been used in simulations, e-commerce and games and there has been much speculation over how Google will make use of it.

Given the curiosity over this deal and the success of other existing companies making use of AI, we take a deeper look into the subject to understand what it is, what its applications are and who is already exploiting it.

In our last piece about the sustainability of UK growth we concluded by querying the effectiveness of the current economic sector classifications and raised the concept of 'digital manufacturing'.

Are forecasted increases in UK growth rates set to continue? – source: Delta2020

Are forecasted increases in UK growth rates set to continue? – source: Delta2020

Traditional manufacturing, or ‘analogue manufacturing’ as we might choose to call it, accounts for around a tenth of the UK economy. This includes sub divisions such as food products, beverages and tobacco, textiles, wood, paper products and printing, chemicals, metals and much more. This is not a set of activities to be downplayed and as the UK economic picture brightens there are positive signs of growth.

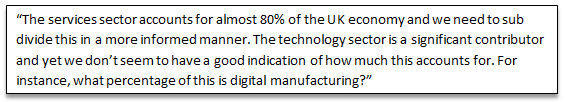

As part of our continued research into the UK economy, we've been looking into tax and recently took to Twitter to share some of our findings. A link to the HMRC data can be found here and a larger version of our HMRC receipts breakdown pie chart here.

Tax principles are concepts by which a government is meant to be guided in designing and implementing an equitable taxation regime. Below we list our 7 principles of a good tax system:

• Simple

• Fair

• Transparent

• Progressive (take proportionately more from the rich)

• Predictable (consistent over time)

• Collectable (cost efficient)

• Incentivise productivity

Do you have a different view? Why not share your thoughts with us by sending a message on twitter to @Thorpesi.

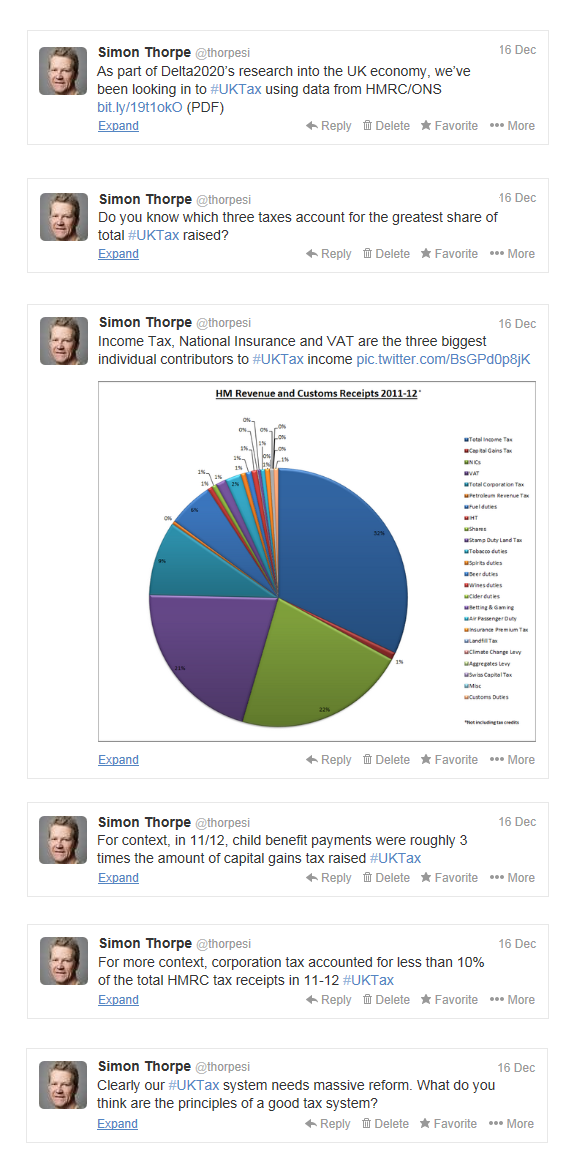

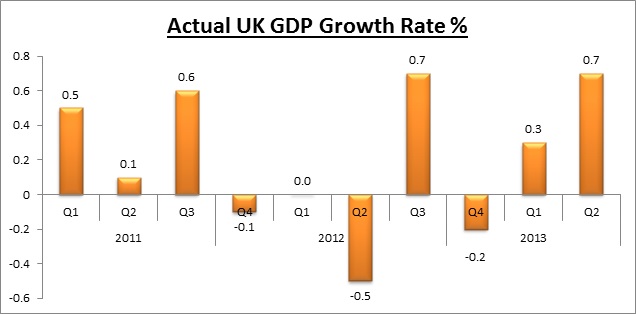

Recent UK GDP quarterly growth rates

Source: ONS

2013 has seen three consecutive quarters of positive growth for the first time since 2011, with the last quarter being the fastest rate of growth for three years. 2012 saw ups and downs on a quarterly basis as momentum struggled to build. The UK economy’s recent performance has seen a marked difference and led the Bank of England (BoE) to say the recovery has “taken hold”.

Growth forecasts upgraded

Over the last few years the general trend has seen forecasted growth rates progressively downgraded. However, over the course of 2013 growing optimism has been reflected in lifted figures. During his Autumn Statement, Chancellor George Osborne announced that the Office for Budget Responsibility (OBR) had increased its UK growth forecast for 2013 from 0.6% to 1.4%. The CBI has also demonstrated an upward trend in its growth forecasts for this year, lifting them from 1% to 1.2% in August and again to 1.4% in November.

|

Predicted UK GDP Growth Rate |

||

|

|

2013 |

2014 |

|

OECD (November) |

1.4 |

2.4 |

|

BoE (November) |

1.6 |

2.8 |

|

PwC (December) |

1.4 |

2.4 |

|

CBI (November) |

1.4 |

2.4 |

|

OBR (December) |

1.4 |

2.4 |

|

Average |

1.44 |

2.48 |

What’s driving this higher growth rate?

The main driver in the UK's recovery has been attributed to rising household consumption. In the latest quarter it is believed that this delivered 0.5% of the 0.8% growth in GDP. A strong raft of economic data has also contributed to upgraded prospects. ONS figures for Q3 show construction, production, manufacturing and services all up. Reassurance that UK interest rates will remain low for some time to come has further added to confidence.

The future rate of growth

Growth rates for 2014 have also been revised upwards. As observed from the table above, the Bank of England are predicting a growth rate of 2.8% for 2014, an increase of 1.1% on forecasts made only two quarters ago. However, it is still early days in the recovery process and the economy remains smaller than it was before the financial crisis.

Are increased growth rates sustainable?

So far the recovery has been driven in the main by increased confidence, consumer spending and housing. To sustain the recovery, a much better balance will need to be achieved. The BoE withdrawing the funding for Lending scheme (FLS) stimulus could be seen as an acknowledgement of this. An increase in corporate investment and Infrastructure spend will go some way to rebalancing the economy but perhaps there should be some recognition that sector classifications need to change. The services sector accounts for almost 80% of the UK economy and we need to sub divide this in a more informed manner. The technology sector is a significant contributor and yet we don’t seem to have a good indication of how much this accounts for. For instance, what percentage of this is digital manufacturing?

More on this in the New Year.

Published: 17/12/2013

Sources:

ONS - Gross Domestic Product Preliminary Estimate, Q3 2013

PwC - Global economy watch | Projections

OECD - Economic Outlook

CBI - UK now on a steady growth path through 2015 and beyond - CBI

OBR - Economic and fiscal outlook December 2013

The Independent - Bank of England upgrades growth forecast for UK economy

The volume of data the world is generating is growing at an ever rapid pace. 90% of all the data in the world has been generated over the last two years. We are more mobile and sharing more data than ever before. Communication is based on the transmission of data, but we are not always aware of the data that exists behind the data we send.

What is Metadata?

Metadata is data that describes data. It helps bring context to content. The term refers to any structured data used to aid the identification, description and location of networked electronic resources. It is generated automatically when using technology whenever data is created, acquired, added to, deleted from, or updated.

There are three main types of metadata:

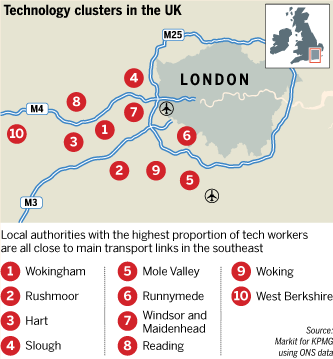

A report compiled by Markit and KPMG has highlighted the strong performance of the UK technology sector in comparison to the private sector overall. Markit polled 150 tech companies as part of its regular survey of 1000 companies operating in the UK. The report identified tech employment clusters, job hiring and growth trends as well as business outlook expectations. Presented is an encouraging portrait of the UK tech sector.

Here are some of the key findings:

Location of UK technology sector employment clusters

- Wokingham has the highest number of tech jobs in Great Britain, with a proportion of more than five times the UK average. This may be explained by Microsoft and Oracle's UK HQ’s being situated there.

- The top 10 tech jobs clusters are all close to major transport links in the South East.

- 70% of all local authorities in the South East have a higher proportion of tech jobs than the UK average.

- Outside of the South East, the regions with the highest local authority tech jobs quotients, were Tewkesbury (11th overall), Christchurch (15th overall), Cambridge (18th overall), South Cambridgeshire (21st overall).

Job hiring and growth trends

- The number of jobs in the sector now exceeds 1m out of a total of 28m employees across all UK sectors (~3.57%). This compares with 915,000 out of 27m in 2010 (3.39%).

- For the last four years, jobs in the tech sector have grown more rapidly than the private sector overall. Employment in the tech sector year on year for the first half of 2013 rose by 4.3% compared with 0.9% for the private sector as a whole.

- UK tech sector output growth is the fastest since May 2010.

Business outlook

- 83% of tech companies in the UK forecast a growth of business activity over the coming year, compared with 60% across all sectors.

- Tech companies’ expectations for business activity are at their highest since 2009.

- Tech companies employment levels are expected to be higher than the private sector average – a net balance of +31% for tech companies compared with the private sector net balance of +23%.

Notes

‘Technology sector’ terminology - The Markit and KPMG report classifies technology sector employment as a ‘workplace based’ concept, rather than an ‘occupation based’ concept. The report has also estimated that a weighted combination of the following five SIC categories represents the best available bellwether for the footprint of ‘technology jobs’ within UK local authorities.

The ‘Technology Sector’ industry groups:

- Software publishing (SIC 582).

- Computer programming, consultancy and related activities (SIC 620).

- Data processing, hosting and related activities; web portals (SIC 631).

- Manufacture of computer, electronic and optical products (SIC 26).

- Manufacture of electrical equipment (SIC 27).

Sources:

UK technology job creation outpaced other sectors for four years

What is it?

Wearable technology refers to small electronic devices that are worn by the user. Devices exist in many forms including glasses, watches and clothing. The emergence of this new range of devices has been driven by the growth and integration of sensors, systems and wireless technologies.

Why is it of interest?

The introduction of Google Glass and Pebble, as well a rumoured Apple iWatch have ignited interest. Wearable devices have the potential to offer more interactivity than laptops, smartphones, or tablets. They are designed to be seamlessly included into everyday life.

The UK GDP growth rate

Source: ONS

2013 has seen two consecutive quarters of positive growth for the first time since 2011. Last year saw ups and downs on a quarterly basis as momentum struggled to build. The first half of 2013 suggests an economic recovery is gathering pace.

The direction of forecasts have changed

Over the last few years the general trend has seen forecasted growth rates progressively downgraded. However, over the last couple of months growing optimism is reflected in lifted figures. The Bank of England recently raised its growth forecast from 1.2pc to 1.4pc and the CBI has lifted its forecast from 1% to 1.2% for this year.

|

Predicted UK GDP Growth Rates |

||

|

|

2013 |

2014 |

|

OECD (September) |

1.5 |

1.5 |

|

B. of E. (August) |

1.4 |

2.5 |

|

PwC (August) |

1.0 |

2.0 |

|

IMF (July) |

0.9 |

1.5 |

|

CBI (August) |

1.2 |

2.3 |

|

Average |

1.20 |

1.96 |

Why the change?

On the domestic front, a strong raft of economic data (retail, manufacturing, services, construction and the housing sectors have all been gathering pace) have upgraded prospects. Reassurance that UK interest rates will remain low for some time to come has added to confidence. Further support also comes from recent figures which showed the Eurozone, The UK’s biggest trading partner, emerging from recession.

The future rate of growth

It is still early days in the recovery process but growth rates for 2014 have also been revised upwards. As observed from the table above, the Bank of England and the CBI are predicting growth rates for 2014 of 2.5pc (previously 1.7pc) and 2.3pc (previously 2pc) respectively.

Is a 2%+ growth rate achievable?

Growth rates of 2pc and above could be viewed as high and may prove challenging to sustain. While 2014 could see a bounce back, without firm economic footing, potential exists for it to lead to weak growth the following year. Taking the view that 2pc growth rates are not achievable unless significant economic reform is undertaken, an annual growth rate of 1pc will be considered good.

Updated: 05/09/2013

Sources:

ONS - Gross Domestic Product Preliminary Estimate, Q2 2013

PwC - Global economy watch | Projections

OECD - Economic Outlook

IMF - World Economic Outlook Update

BBC - Economy Tracker

The Telegraph - Mark Carney Inflation Report

Businessweek - UK growth forecasts raised by CBI as recovery builds momentum

Angel investment is vital to the UK economy as a source of risk capital to facilitate growth. Deloitte and the UK Business Angels Association (UKBAA) recently collaborated to produce the first study of the UK angel market since 2009, to which I contributed.

Here are 10 key findings:

1. Over 50% of all UK angel invested capital in 12/13 was in internet and digital businesses

2. 54% of all 12/13 UK angel investment was in the South East

3. Only 5% of investors in the market place are currently women

4. Co-investing between VCs and angels is growing as value is seen in bringing angels on board for their business experience

5. 74% of deals surveyed took advantage of the EIS scheme

6. 73% of angels are co-investing alongside other angels to build their deals

7. 90% of angel capital went in to seed/start-up/early stage businesses, with the remaining 10% spread across late stage ventures/expansion/established and turnarounds

8. Investment on equity crowdfunding platforms is growing fast, with amounts doubling year on year over the last three years

9. 77% of angels surveyed felt valuations were higher than in previous years

10. Lack of liquidity was identified as the number one challenge for most angels interviewed in the survey

Source: Taking the Pulse of the angel market. For the full report click here (pdf – 1.29MB)

Big data is the term used to describe the vast quantity of unstructured data that simple database tools could not harness. Now, through use of new big data analytic platforms, it is more accessible than ever. IBM have produced an infographic breaking the topic down into four dimensions: volume, velocity, variety, and veracity. Big data encompasses all types of perceivable datasets, from website analytics to crime statistics to medical research and beyond. Big data can be leveraged into valuable information which can enhance opportunities for large corporations, small start-ups and even the general public.

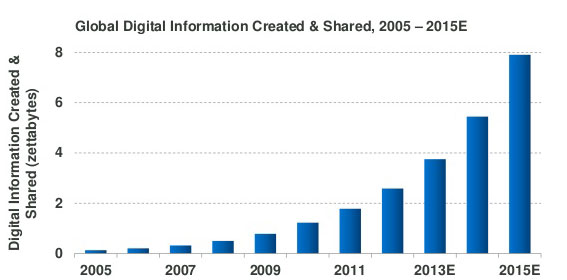

In this age of ubiquitous computing and connectivity there are more data points than ever. For example the rise of 4G on mobile devices, greater GPS technology and ever-growing social networks on Facebook, Twitter and LinkedIn (which have 1.16 billion users, 465 million users and 225 million users respectively), all add to the volume of data – 2.7 zettabytes* was created and shared in 2012. It’s noteworthy that 90% of the world’s current data has been created and shared in the last two years, as illustrated by the graph below and the trend in volume is expected to continue. Therefore there has never been a more appropriate time to harness this data.

Big data can boost business efficiency and sales. Businesses can use it to find insights into new and emerging data that was previously inaccessible. It enables them to understand their market demographics better and make informed predictions – without having to be a qualified data scientist. The benefits to businesses are that they can reduce costs, improve pricing, understand the customer better and thus increase revenue.

The increasing amount of data and the increasing opportunities to derive value from it, present a new source of competitive advantage. Big data is becoming increasingly prominent and the analytic platforms look set to go mainstream.

* 1 Zettabyte = 1,000,000,000,000,000,000,000 bytes

By Edward Rowley and Toby Smollett

Sources: IBM: “What is big data?”, FT blogs, Forbes: “What big data can do for small businesses”, ICAEW: Big Data help-sheet, IDC "Extracting Value from Chaos".