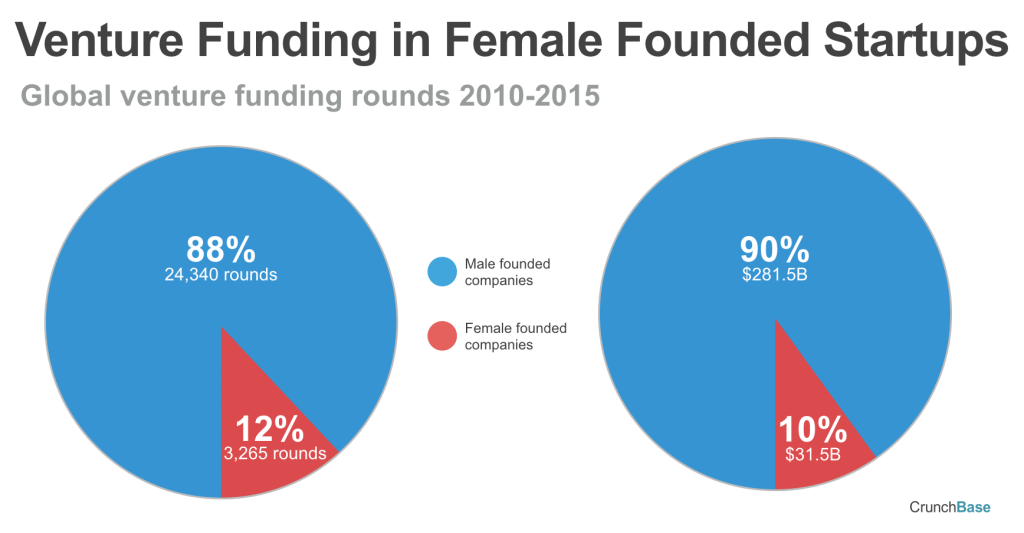

The CrunchBase Women in Venture report is the third study in their ongoing analysis of women and their participation in the startup ecosystem. It explores how many women are true investing partners and which venture firms have a strong track record of supporting startups with a least one female co-founder.

TechCityinsider reports and promotes the next generation of digital businesses. Here we share their latest podcast TECH TALK 39 on why investing in female tech founders is important.

Angel Insights takes you inside the world of angel investing, startup funding and equity crowdfunding. In the latest podcast host Harry Stebbings interviews Simon Thorpe on the ups and downs of startup investing.

"1 Billion young people will start work in the next decade - only 40% in jobs that now exist"

The Economist, 23 Jan 2016

Founders4Schools’ mission is to improve the life chances of students by giving them access to inspiring business leaders in their community who help them discover the skills and pathways that will be relevant when they leave education.

It is a FREE nationwide service that enables teachers to connect with leaders of successful, growing businesses to invite them to visit their schools and inspire their students.

F4Schools want all students in the UK to be well-informed about their future options, motivated to succeed and to lead enterprising lives.

Here we share their video that explains the program.

The disruptive properties and revolutionary capabilities of blockchain have become a popular theme. Touched on briefly in our previous article "Bitcoin boom or bust". It could be the most disruptive piece of technology to surface over the past few years, but what exactly is blockchain and why is it so disruptive?

The first generation Apple Watch launched into the Smartwatch Market last April with great confidence, looking to lead the way amongst other Smartwatch brands and leap forward on the technology curve. However being reliant on the iPhone (models 5s onwards) and prices starting at £299 for the 38mm model, it would see only the innovators being first to embrace it.

"Scaling-Up" - Research shows that a large proportion of economic growth comes from a relatively small number of highly productive, fast growing firms. Here we share a link to Sherry Coutu's presentation on the importance of scaling-up for the UK economy.

Delighted for the Swiftkey Founders. Here is a good piece on what Swiftkey's acquisition means for UK Tech Exits.

Microsoft is acquiring London-based SwiftKey, a predictive-keyboard app maker, for a reported USD250m, which represents a good exit for the two founders and its investors, which had pumped USD21.59m into the company to date. Powered by artificial intelligence (AI), the app fits neatly into Microsoft’s ongoing attempts to build up its mobile and productivity services, as well as its AI and language recognition capabilities. SwiftKey will continue to function as normal with Microsoft saying that it will, “explore scenarios for the integration of the core technology across the breadth of our product and services portfolio.”

Here we post Business Weekly’s article published on 13th January 2016, offering an insight to the growth of the digital economy.

Next year the consensus forecast for world growth is 2.6% and for the UK, 2.5%. We are optimistic about next year, however, there are plenty of risks to watch.

Here are our thoughts on the outlook for the UK economy in 2016:

1. Oil Prices – Lower for longer

Oil has continued to tumble throughout 2015 as Brent crude and WTI crude are down close to 40% at 11-year-lows priced at $36 and $34 respectively. Forecasts for oil prices ranging from $25 - $60 per barrel; with Iran pledging to boost exports and OPEC holding a firm stance on their supply we believe that oil has lower to go before it starts to strengthen.

This year’s theme is digital disruption. Here we build on December 2015’s research Looking Forward to 2015: Ten Themes for Technology. We will be tracking the following prominent technology themes during the course of 2016.

1. Security and Privacy – Not just for the individual

“The digital revolution is the new industrial revolution”. This exponential growth of the digital age has highlighted severe deficiencies with the protection of sensitive information and data. A recent survey by PwC, found that 90 per cent of large UK organisations had reported a cyber attack this year, up from 81 per cent a year earlier, highlighting the need for cybercrime legislation. 2016 will need a big leap in becoming a global movement to help protect individuals as well as big corporations.

Venturing forth – the push and pull of early stage valuations

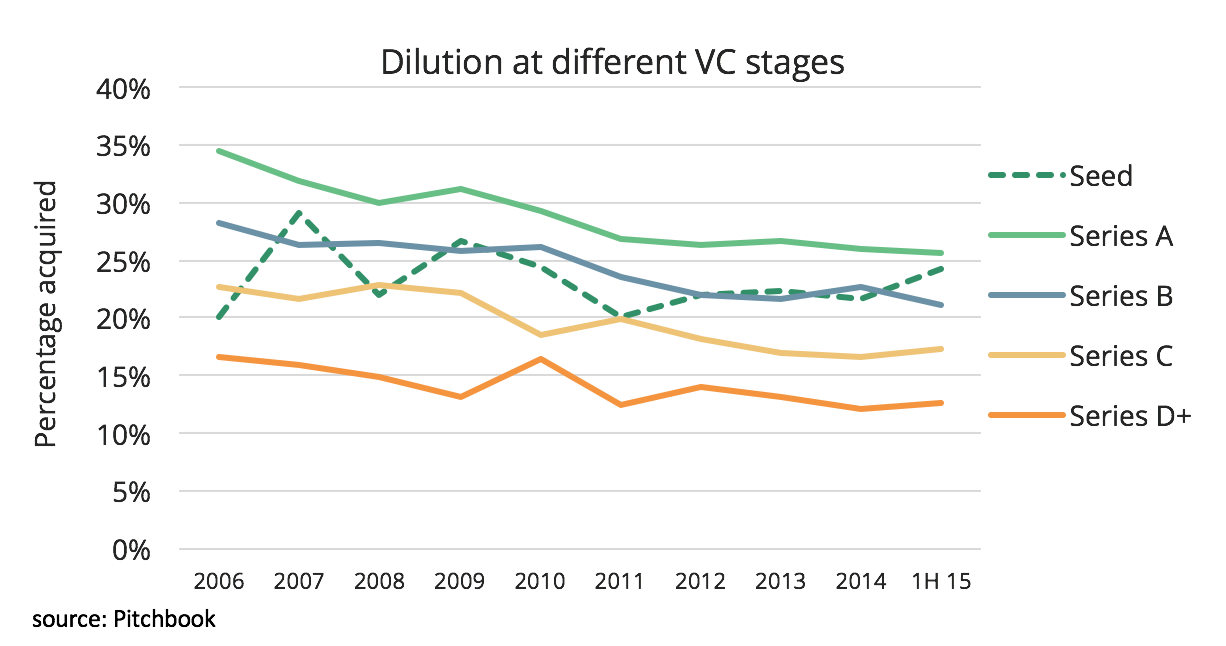

Company valuation is difficult enough in public markets but for early stage companies, lack of track record and profits means that valuation rests mostly on what someone is prepared to pay. Apple’s valuation crystallises every fraction of a second during stock market hours when a trade is booked, but private company valuation crystallises about annually, when investors hand over cash to company management and become shareholders. Company value at this moment equates to funds raised divided by the percentage of the company sold to new investors. This sounds obvious but it means management needs to convince investors that the cash handed over is appropriate to the business needs and will get the business to its next, higher valuation milestone, and that will determine dilution. Our friends at Go4Venture help us “do the math”.