What is contactless?

There were 1 billion UK contactless purchases made on credit and debit cards worth £7.75bn in 2015 which was more than double the previous seven years combined.

As mobile technologies are increasingly evolving into 'wearables', Augmented Reality and Virtual Reality (AR/VR) solutions continue to capture the imaginations of millions and are expected to exceed 24 million in device sales by 2018. Whilst on work experience Gabriella Freeman (Yr10 student) from St. Mary's Catholic School looked into its many possibilities for enhancing and improving the education system.

Augmented Reality is the technology that superimposes a computer-generated image on a user's view of the real world. This is highly popular within the gaming world as seen through the popularity of the Pokémon game: Pokémon Go.

Virtual and Augmented Reality applications represent the next stage in human interaction with technology. With the recent mainstream success of Pokemon Go, Daniel Short (Yr10 student) from St. Mary's Catholic School decided to research both realities whilst on work experience here.

In March 2015, we wrote about a tale of two realities, Virtual and Augmented Reality. At this time, both of these were still in their infancy, and had not yet been widely used in everyday life, and things like google glass or Microsoft HoloLens were extremely expensive, making it almost impossible for everyday buyers to get their hands on a piece of this advanced and complex tech. Therefore, I have decided to write this article, to explain just how far these two new realities have come in the last 18 months, and where they are being used in society and everyday life.

Passwords have long been the default option for verifying a user's identity. However, the sheer volume of them can be difficult to remember and they are increasingly susceptible to being stolen. While on work experience Ciaran Hollebrand (Yr10 student) from St. Mary's Catholic School explored the advancing technologies in biometric identification that are becoming an emerging replacement.

Recent advancements in the biometric identification and verification industry have made sure that it is almost impossible to bypass the extreme accuracy of a biometric identification device. Soon it will be as easy as picking up your phone or holding your device to unlock it.

Andrew Griffin from Oakhall Advisors shares his thoughts on the sometimes tedious task of reading an IPO prospectus.

http://www.oakhalladvisors.com/is-life-too-short-to-read-an-ipo-prospectus/

3D printing also known as additive manufacturing, turns digital 3D models into solid objects by building them up in layers. Whilst on work experience Christopher Wilkin (Yr11 student) from The Bishop's Stortford College explored the growing developments of this technology.

One of this decade’s most technologically advanced developments in the modelling industry was the development of the 3D printer. When given the correct instructions, it can recreate what was just a virtual object, designed with mouse and keyboard on a computer, into a real object that you can touch and hold. Previously, prototypes for complex designs were created through long, laborious processes, often done completely by hand due to the unique nature of the designs. Now, with the aid of 3D printers, the same models can be sculpted in front of your very eyes in just a few hours.

Whilst on work experience Lauren Beaver (Yr11 student) from The Bishop's Stortford College explored the growth of the 'smart city' phenomenon.

Before we can talk about the future of smart cities and their benefits we must ask what they actually are?

Work Experience student Christopher Wilkin also investigated the 'hot topic' of immigration looking at its contribution to the UK economy and its effects on population growth.

In 2015, over half of the UK’s population growth came from immigration alone, with a net total of over 333,000 migrants entering the country. These immigrants can have both positive and negative impacts on our economy, but why is this, and what effects do they have?

A new wave of innovation, led by car manufacturers and automotive-tech companies, is transforming the driving experience. Louis Dolding from the University of Nottingham has written a an article on the future of vehicle technology.

Looking back at cars of the early ‘noughties’ where heated seats, Bluetooth and an AUX socket were considered luxuries in an everyday saloon, it is difficult to comprehend how the cars of today have progressed so rapidly. Driven by new innovations and huge advancements in technology over the last decade, comforts such as cruise control, SatNav and parking sensors are now common place in even the most affordable of hatchbacks. With this is mind it is no wonder that car enthusiasts eagerly predict what advancements may be coming to the cars of the future.

Phoebe Seymour (Yr12 student) from The Bishop's Stortford High School researched the topic of Artificial Intelligence (AI) to understand why fewer women are pursuing AI careers when the majority of the constructed AI personalities are female.

It is common knowledge within the tech world that there is a severe lack of women in the artificial intelligence (AI) field. Statistically, 50% of all A-Level physics classes in the UK do not contain girls according to Sherry Coutu, and women received just 18% of undergraduate computer-science degrees in 2011 (National Centre for Education statistics).

Wearable technology is playing a growing role in sport all over the world, used to help coaches, trainers and general managers maximize player performance. While on work experience, Daniel Fernandes (Yr12 student) of The Bishop’s Stortford High School explored how ‘wearables’ are shaping the future of sport.

The wearable technology industry is growing at an extremely rapid rate, currently selling $14bn worth of wearables and expected to increase to $34.2bn by 2020. Everyday new wearable tech, commonly referred to as ‘wearables’, is released; and people are buying them. The range of wearable technology is vast, with some established businesses (Tommy Hilfiger), offering solar powered jackets that act as portable chargers, and some smaller businesses (Future Interfaces Group) enabling you to use your skin as a touchpad, with their new technology- SkinTrack. The range of wearable technology is truly extensive.

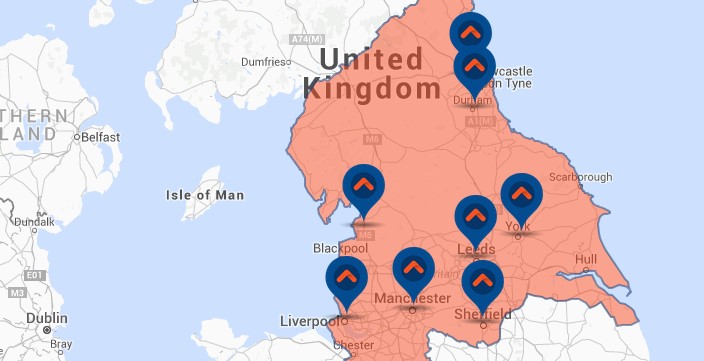

The North of England has long been at the heart of British innovation since the industrial revolution. Whilst on work experience Luke Cooper (Yr12 student) from The Bishop's Stortford High School looked further into the new emerging digital ecosystem of the Northern Powerhouse.

The digital revolution in the North is growing 4 times faster than the non-digital sectors. In the Northern Powerhouse area (highlighted red on map) major cities such as Manchester and Liverpool the have a rapid digital economy growth rate of 13% and 7% respectively between 2011 – 2014.