Here we share a recent article written by Andrew Griffin from Oakhall Advisors that provides a valuable insight for private companies on how to pitch to potential investors.

Pitch perfect

Most pitches by private companies to potential investors fail. Bad ideas are of course the main problem, but the way companies communicate is also a barrier. Putting your pitch together in a way that actually answers investors’ questions in a structured way will help you identify if you have thought your strategy through properly.

At college we are taught to write and argue in a certain way, working through evidence and arguments and winding up at a conclusion.

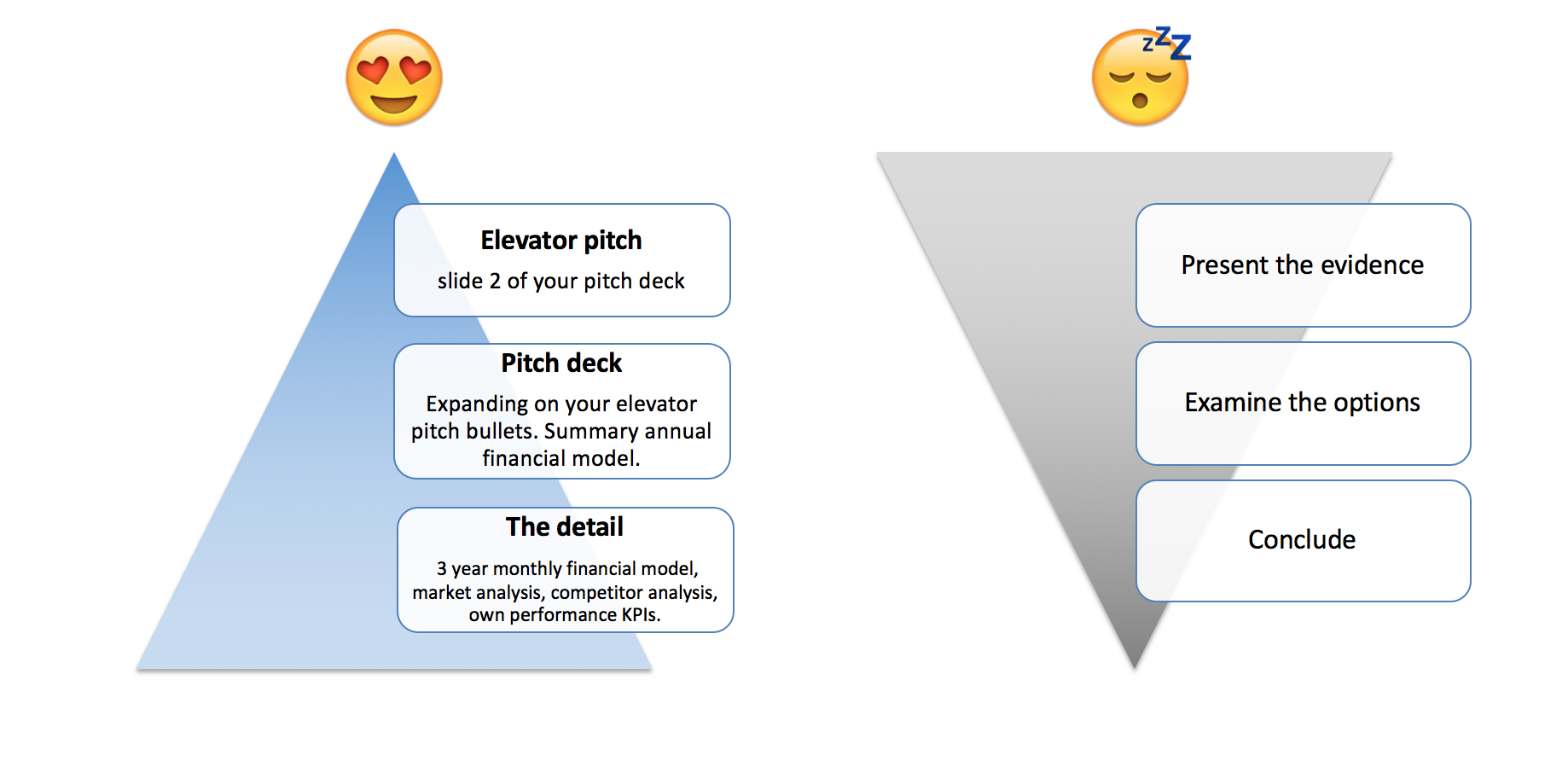

Investment writing has to start with the conclusion and then let the reader work through the arguments to reach that conclusion themselves. My first couple of years as a sell-side equity analyst were spent having this beaten out of me by my boss and mentor, and 20 years later, good friend.

Professional investors see hundreds of of pitches a year, and active angel investors probably tens. They are impatient and have short attention spans. Preparing slides with the intention of answering a standard list of questions that investors inevitably always ask will describe the business in a way that makes it easier for investors to receive the message and feel that you know what they need.

This isn’t the way most companies pitch their businesses. Founders typically sit down and try to describe their business from their point of view, which can end up missing out areas that are important to investors.

Here’s our list of the typical questions. It looks like an obvious list but you’d be surprised how few pitches answer them all clearly:

- What does your company do?

- What is the plan (roadmap)?

- What is the business model (how do you make money)?

- Who do you sell to?

- How big is the potential market and who do you compete with?

- Who are you (the founders)?

- How much do you want, and at what valuation?

- Show me the numbers: cash flow forecasts, income model, cost model.

Moving on to building the deck – start by answering all of the above questions in bullet form. This becomes your summary side (number 2), and is your elevator pitch. The rest of the deck is then an expansion of one slide per bullet, plus some financial forecasts. In the “slide guide” below below we run through a sample slide deck, page by page.

There is of course much more to it than this – your idea must actually be a good one, your team the right choice (maybe you need to step aside from the CEO role), and you need to target appropriate investors. But preparing honest answers to this list of questions might help you find the holes in your argument before an investor does.

Thoughts – especially from professional investors – are most welcome.

Oakhall slide guide

Here’s a page-by-page sample pitch deck structure summary plus some do’s and don’ts. The order may need adjusting to suit your business – for instance you may need to explain your market before talking about who you sell to, or how you make money.

1. COVER

Your branding, product/service image, company tagline.

2. SUMMARY

Write this first incorporating bullet point answer to the question list in the article. The aim is that everything you think is important is in this slide in short, punchy, bullet form. We do not want investors learning something important on a later page, and they hate having to wait several slides to get to important stuff. This is not about creating suspense! You can use answers to the questions above to frame your bullet points.

3. WHAT WE DO

Images are always good here – screenshots if you are an app or online business. You don’t need to write it out – remember:

the pitch deck is here to support what you are saying.

Avoid comparisons and buzzwords. If you are a cloud or SaaS company, let the investor work that out, don’t join the thousands of businesses that call themselves a cloud business simply because they run their websites on a third party datacentre.

Similarly, avoid the very common “we are the Uber/Airbnb/Tinder of…”. Back in the 1980’s a number of tech giants were spawned. But there is no “Microsoft of….” that I’m aware of. Stand up on your own. Good investors avoid “me too’s”.

4. PRODUCT ROADMAP

The point of this slide is to show investors that you have thought of every angle and to get into a discussion about the opportunities ahead. It can be a timeline, but it could also be a spider diagram. No one is going to hold you to this roadmap as companies always pivot. A good discussion will flesh out for you which investors you would most value having on board. This is not a one way street.

5. BUSINESS MODEL

This should be a very simple slide from which investors should be able to work out how you make money; your profitability and capital intensity model.

6. MARKET SIZING

Investors love to size your market, and work out that, say, you only need to get 2% penetration to double their money. They also like to know if it’s a growing market. Help them with the numbers and industry analysis.

Who do you sell to? Investors like to distinguish between businesses selling to consumers (B2C) and to other businesses (B2B). B2B is often more difficult to set up, but likely has higher barriers to entry once set up. In Europe there seems to be a dearth of successful B2B start ups.

7. COMPETITION

A good one slide competitive analysis showing a logo cloud of the companies you have found that might compete or have a similar idea shows that you have thought about potential competition and why you will still win. “We have no competitors” is not a good message – there is always competition, even if it is indirect, such as in-house departments that would be better outsourced to you. Competition makes a market, it is not a bad thing. Having said that, you have to differentiate.

8. WHO WE ARE

Brief CEO and other biographies. You can include other existing investors and advisors here if appropriate. Many investors see the team as the key factor that they invest in. If you are a CEO raising a lot of money but have little business experience, be prepared for suggestions of bringing in a more experienced CEO.

9. FUND RAISE

How much you are raising, and the percentage of the company that investors will subsequently own, and the value of the company that implies (so for instance $2m for a 20% stake in the business, valuing it at $10m). Add here founder and other shareholdings, and any other appropriate points such as tax incentives (EIS or SEIS in the UK for instance).

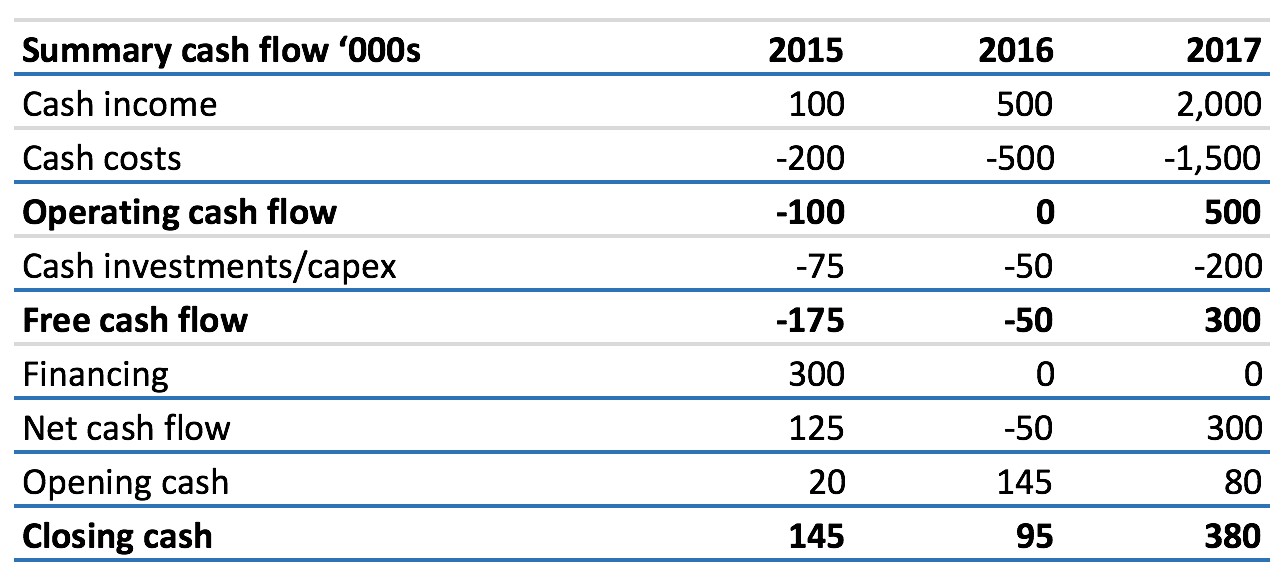

10. SUMMARY CASH FLOW

Just five lines (cash income, costs, capex, financing and cash) plus a few subtotals.

The object here is to present the 30,000 ft view of how you expect the business to work.

Almost all early stage CEO’s we meet mess this part up. Most simply don’t publish a cash flow. If they do, they confuse free cash flow (the important number – what your business generates after all costs and capital spending) with net cash flow, which includes investment cash in.

Behind this professional investors will expect a much more detailed model on a monthly rather than annual basis, but stick to this summary for the pitch deck.

Investors will in particular want to delve into the income and costs, hence the final two slides.

It goes without saying that the cash flow needs to logically back up the funds you are raising. If your minimum cash level is very high in your forecast, investors may question why you need to raise so much. If you are getting close to zero, they may suggest you need more.

11. INCOME MODEL

This should help explain how your revenue is derived. If you are selling a product then show product volumes and price. If you operate in several markets, show them line by line.

12. COST MODEL

People costs are usually the biggest item here. But also show variable costs associated with revenue. Variable costs might be cost of materials for a physical product, or app store fee paid to Apple or Google for an app. “Contribution”, or gross profit, is revenue less variable cost and is worth stating, either in slide 11 or 12 – it’s a more important metric than revenue.

DO

- Change the slide titles to convey the answer rather than question, so “$15bn market potential across Europe” rather than “Market size”

- Provide third party evidence as much as possible – what you say about your business will be ignored unless you have a stellar track record in the same field.

- Present data (numbers) that the investor could not have discovered elsewhere. This good advice comes from a VC friend. Data from your initial trials (it could be selling price, usage, cost-of-customer acquisition), or net promoter scores, or app downloads all work very well in providing third party feedback.

- Use images, graphs, tables as much as possible, instead of words – remember the deck supports what you say, it doesn’t have to say everything for you. Slides crammed with words don’t work.

- Show that you have really researched the competition.

- Avoid spurious numerical accuracy. It makes your deck more difficult to read and no one believes you can forecast that accurately anyway. If your 2017 revenues are expected to be $1,137,988.54 and to have grown 45.87%, your financial tables should be in units of $1000 or $m and show revenue as 1,137k or 1.1m and growth at 46%.

- Think about your next fund raise (if needed) when setting the terms for this one. Your financial model should implicitly support a next fund raise. Think about how that might dilute you further.

- Think about what return you are likely to give your investors. It will help you understand where they are coming from when they talk about valuation. You and your investors will want your next stage valuation to be much higher than the first, driven by the growth you have shown in the mean time. Let’s say you want the next fundraise to be at double the valuation of your first. What rate of return does that imply? Doubling your money doesn’t mean 100% rate of return, it depends on how long it takes you – compounding is something we humans find difficult to work out in our heads. Here’s a helpful table:

So if it takes you two years to reach the next funding milestone and you double the value of your business, that’s about a 40% rate of return for your initial investors. That should be fine for most. Thinking about it this way gets away from some of the annoying “we’re looking for the next Facebook” nonsense that you sometimes hear.

DON’T

- suggest several ideas (“…and if that doesn’t work, we could do this….”) -lack of focus is very unattractive. But a central idea that breeds many product ideas works well.

- use too many words, the pitch deck is to support your presentation and should not stand alone (put together a Word document with your pitch deck images adding a commentary if you feel the need for that). Avoid word only slides altogether apart from the summary

- add more slides – if you really feel the need, put supplementary slides in an appendix. I recently sat through a 40+ slide pitch deck. It was rambling, repetitive, and poorly structured.

- quote yourselves. You are obviously biased and even if you are an acknowledged industry expert, your presence at the company speaks for itself.

- make a key attribute of the pitch the fact that other, well known investors or industry titans have invested, or agreed to be chairman or non exec. Leave this as icing on the cake at the end. If your pitch needs this fillip as part of the main investment case, then it is a weak investment case. No decent investor follows other investors. Early stage companies need investors for their advice and networks as much as their money, and “followers” rarely provide good advice.

- Accept onerous preference terms on the shares . Downside protection for new investors causes all sorts of problems in our view (see our previous insight on this topic).

- Go for the highest valuation. It is becoming clear that crowdfunding is leading to some pretty punchy early stage valuations, driven by amateur investors who aren’t that financially literate. It causes problems if you go to series A funding with professional investors on the back of too-high an valuation. A good team of early advisor/investors is invaluable.

31/08/2015